- Economy

- 2023 Jan 23 Jan 2023

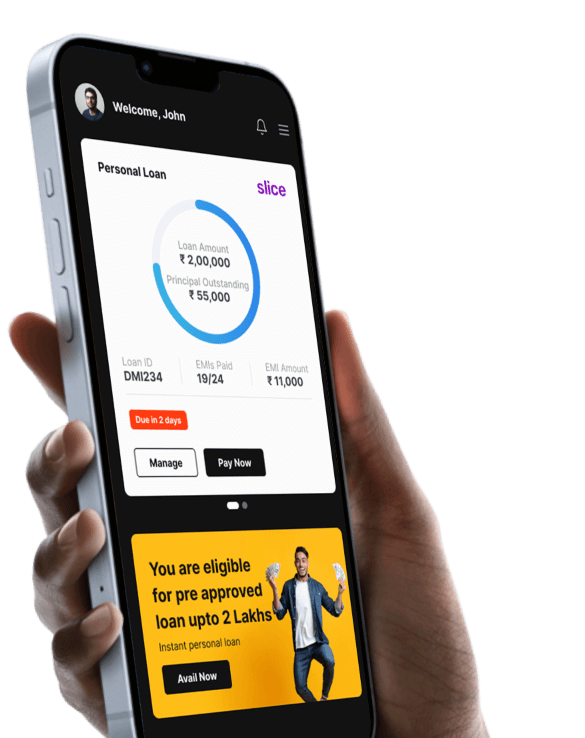

A simple EMI calculator to plan your payments.

₹10,000 ₹10,00,000

12 Months 48 Months

11% 28%

Avail DMI personal loan to meet any financial requirement, be it for funding your wedding, travel, hospital bills, or any unplanned expenses.

Fully digital and it only takes a couple of minutes.

MOBiUS is a first-of-a-kind loan subscription product which is tailor-made for you. Now, you will be in the driver’s seat to decide when and how you need the funds without worrying about the paperwork and stressful approval procedure.

Quick and easy support for your loan disbursal and repayment.

Yes, applying for a loan online has many advantages:

No, there are no tax benefits associated with a Personal Loan.

Personal Loan tenure can range from 3 months to 48 months.

Yes, there are pre-closure charges associated with loans. They generally range from 2% to 4%.

Missing an EMI payment can lead to late fees and negatively impact your credit score. Continuous defaults could result in legal action.

No, a Personal Loan is available to both salaried and self-employed individuals.