You can apply for loans through various mediums, such as the website, mobile app, missed call facility, email ID, and branch visit.

Apply via Website:

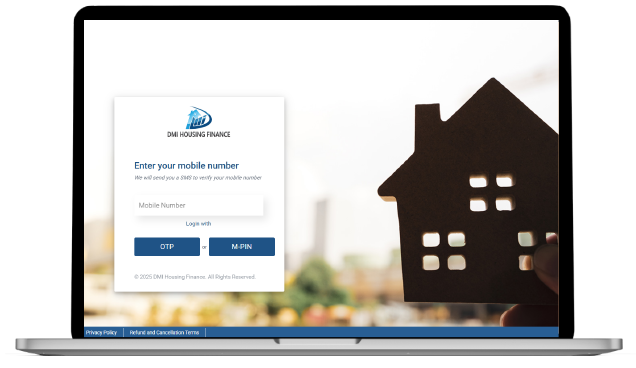

- Access the Customer Portal: Visit the "Customer's Corner" on our website.

- Log In: Enter your mobile number and log in using the OTP sent to your mobile device.

- Apply for a New Loan: Click the "Apply New Loan" option.

- Fill Out Your Details:

- Personal Information: Provide your basic personal details.

- Employment Information: Enter your employment details to help us tailor your loan offer.

- Loan Offer Check: Review the loan offer available for you.

- Document Upload: Upload the necessary documents for verification.

- Track Your Application: Once you submit your application, you can monitor its progress in the "Existing Loan" section.

Apply via the Mobile App::

- Download the App: Go to the Play Store and download the DMI Home Loans app.

- Log In: Log in securely with the OTP sent to your mobile.

- Apply for a New Loan: Select the "Apply New Loan" option.

- Complete Your Application:

- Personal Information: Your Name, Address, etc.

- Employment Information: Salaried, Self-Employed, Income Details, etc.

- Loan Offer Check: View the loan offer customised for you.

- Document Upload: Upload the required documents directly through the

app.

- Track Your Application: The "Existing Loan" section of the app allows you to monitor your loan application status.

Apply via Missed Call Facility:

You can give us a missed call at 9772027704, and our team will call you back.

Apply via Email:

You can write to us at Customercare@dmihousingfinance.in

Apply via Branch Visit:

You can visit the nearest branch of DMI Housing Finance. Click here to locate it.

Give us a Missed Call: 97720277704

Give us a Missed Call: 97720277704

Call Us: 011-66107107

Branch Locator

Branch Locator

Become a Partner

Download App

Pay EMI

Download App

Download App

Pay EMI

Pay EMI